Circular Financing in AI

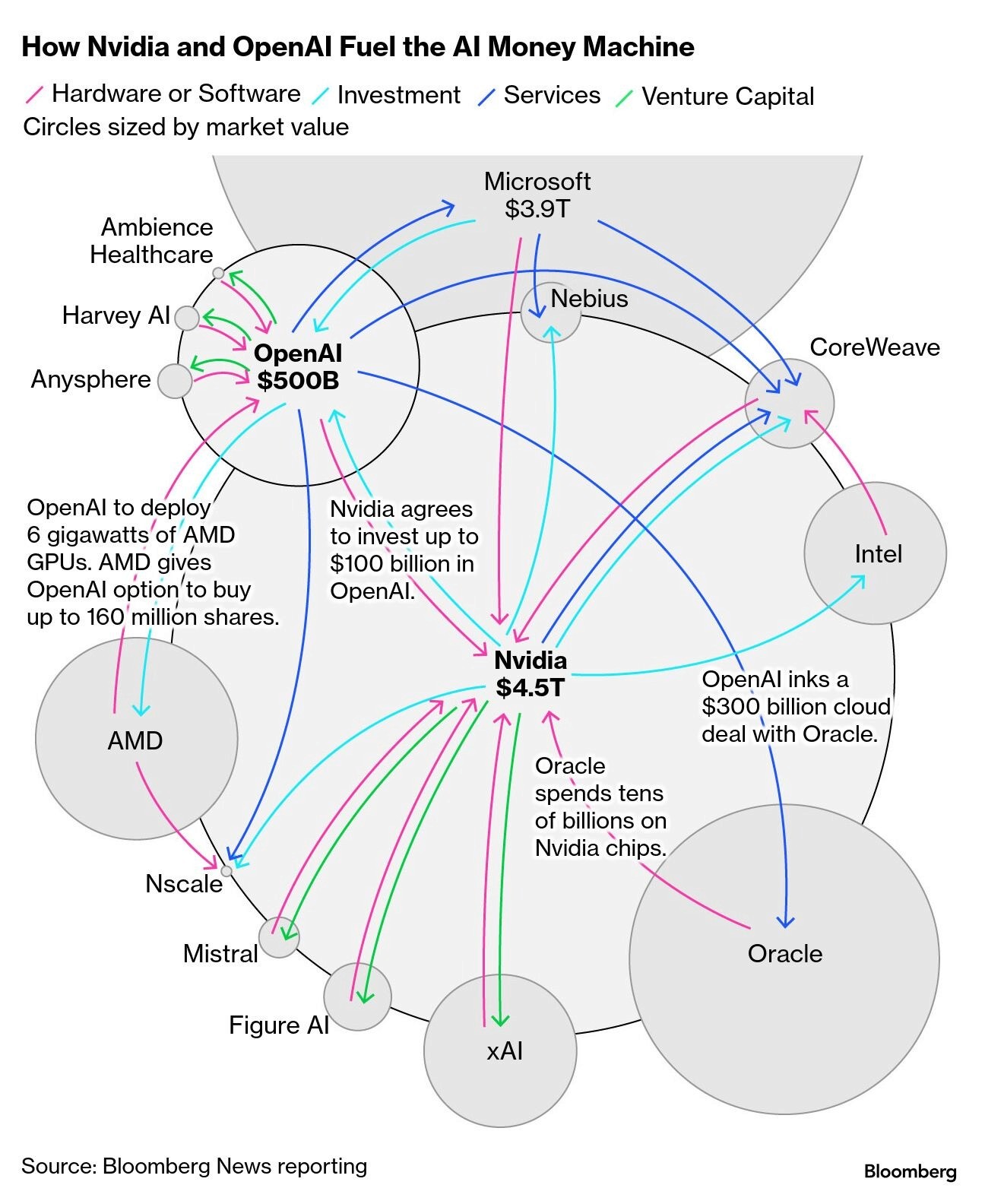

If you follow AI infrastructure at all, you’ve likely seen the Bloomberg graphic mapping the dense web of relationships between NVIDIA, OpenAI, Microsoft, Oracle, CoreWeave, and a growing list of model labs and GPU clouds. Capital flows in one direction, compute flows in another, equity stakes loop back, and long-term contracts seem to anchor everything in place.

To some, the image looks like an “AI money machine” - a closed loop where companies appear to fund each other’s growth. In reality, it is something far more familiar to infrastructure and project finance veterans: a market improvising under extreme supply constraints.

What’s being called circular financing is not financial sleight of hand. It is a way to pull future compute demand into the present, allowing physical infrastructure to be financed and built before traditional markets for pricing, hedging, and risk transfer fully exist.

Circular Financing: what it is, how it works, and who's involved

In the AI ecosystem, circular financing refers to interlocking capital and commercial arrangements among the same set of counterparties (chip suppliers, frontier model labs, cloud providers, and infrastructure builders) that collectively finance the production and consumption of compute.

Rather than a single transaction, it’s a system of reinforcing commitments:

equity investments, warrants, or credits,

long-dated take-or-pay compute contracts,

prepayments for hardware or cloud capacity,

utilization guarantees that de-risk lender underwriting,

and revenue-sharing or pricing concessions that substitute for traditional financing costs.

The unifying idea is simple: compute demand arrives faster than compute can be built. GPUs, power, cooling, land, and grid interconnections all move on multi-year timelines. But frontier AI labs cannot wait years for capacity. Delays compound into weaker models, slower deployment, and a durable competitive disadvantage. Finance fills the gap.

How the loop actually works

At the center of the ecosystem sit frontier model developers (OpenAI, Anthropic, xAI, and others) whose willingness to commit to massive, long-term compute usage turns abstract AI demand into something banks and builders can underwrite.

Surrounding them are chip suppliers, led by NVIDIA and increasingly AMD. These firms are not just selling hardware. They are stabilizing demand. Strategic investments or incentives at the model layer help ensure that expensive capacity expansions translate into real deployments.

Next are cloud and infrastructure integrators like Microsoft and Oracle. These firms increasingly function less like “cloud resellers” and more like builders and financiers of physical infrastructure, taking on exposure to power pricing, construction timelines, and balance-sheet leverage in exchange for long-term contracted demand.

Then come GPU-focused clouds and intermediaries, such as CoreWeave, which sit between silicon and end users. These players often operate with thinner margins and higher utilization sensitivity, but they play a crucial role in translating long-term commitments into near-term capacity.

Behind all of this sit data center developers, utilities, and lenders, underwriting projects whose viability depends on one central assumption: that contracted compute demand materializes and persists.

What makes the structure feel “circular” is that the same counterparties appear on both sides of financing and consumption. But economically, this is no different from how power plants, LNG terminals, or telecom networks have long been financed - forward contracts make future cash flows bankable today.

Where circular financing breaks: the real risks

Circular structures don’t fail because they’re circular. They fail when assumptions embedded in long-term commitments stop holding.

Utilization and demand risk

If AI spending slows, inference economics disappoint, or model scaling plateaus, fixed take-or-pay obligations become painful quickly. The question isn’t whether compute demand fluctuates. It’s who is locked into paying when it does.

Balance-sheet and funding risk

Long-term commitments pull capital expenditure forward. That can stress leverage ratios and credit metrics well before cash flows fully arrive, inviting market scrutiny and tighter financing conditions.

Construction and power risk

Delays in grid connections, cooling infrastructure, or permitting push revenue out while interest and fixed costs continue to accrue. In a capital-intensive system, timing matters as much as price.

Technology obsolescence risk

Because these arrangements span equity, contracts, and financing, poor disclosure can make sound economics look suspect. Investors tend to discount what they can’t clearly underwrite.

Across all these risks, the same question keeps reappearing: when conditions worsen, which balance sheet absorbs the shock?

What actually fixes this: how the system matures

Circular financing is not a permanent solution. It is a bridge - a way to clear supply and demand before markets have the tools to do so efficiently. As the AI ecosystem matures, several changes become inevitable.

Standardization of compute contracts: Today’s bespoke agreements bundle pricing, delivery, uptime, and utilization in idiosyncratic ways. Over time, markets will push toward standardized terms that make contracts comparable and transferable.

Better price discovery: Right now, compute pricing is opaque and highly negotiated. Transparent benchmarks (by workload type, duration, and performance tier) are a prerequisite for efficient capital allocation.

Risk separation: In a mature system, utilization risk, price risk, construction risk, and technology risk do not all sit on the same balance sheets. Financial instruments emerge to unbundle and transfer them to the parties best suited to bear them.

Less reliance on balance sheets: As markets develop, fewer projects need to be justified by strategic equity, cross-investments, or utilization guarantees. Capital can flow on the basis of expected returns, not ecosystem loyalty.

At Ornn we're building the market primitives to achieve these ends.

The bottom line

The Bloomberg diagram is not evidence of an AI bubble propped up by self-referential financing. It reflects a system under strain, relying on balance-sheet engineering to compensate for missing market infrastructure. Circular financing accelerates capacity build-outs by tying together capital formation, demand commitments, and risk allocation across a narrow set of counterparties. But in doing so, it concentrates exposure, obscures true pricing, and weakens the signals that normally discipline capital deployment.

These structures persist not because they are robust or sustainable, but because alternatives remain underdeveloped. Circular financing substitutes contractual and balance-sheet complexity for transparent markets and works only so long as demand growth remains strong and assumptions hold. Over time, durable systems must rely less on counterparties underwriting one another’s demand and more on standardized contracts, clear price discovery, and explicit risk transfer. Until then, circular financing remains a fragile stopgap - useful under constraint, but poorly suited as a long-term foundation.