Compute Futures

How to Hedge Compute - Part 2

Right now if you were to open up Bloomberg, the Journal, or your business news source of choice, chances are that you’d see something about a new investment in compute infrastructure. It’s clear that AI is becoming a more integral part of everyday life, and capital markets have been quick to deliver the financing for its proliferation. Despite this massive influx of capital, however, there remains significant opacity in the precise value of compute. Markets have been writing blank checks, as it were.

At Ornn we’re building a futures market in which participants can explicitly trade on this value of compute. Anyone with exposure to the AI value chain can hedge their risks by assuming a futures position. So how does it work?

Cash-settled to a Benchmark

A central unlock from a futures contract is that it allows for cash exposure to compute without dealing with physical delivery. As with any other commodity, many involved parties don’t want to deal with inventory—in the case of compute, financial parties have no interest in managing SLAs, API endpoints, SSH details, etc. Instead, futures are cash-settled to a benchmark tracking the spot value of compute; they pay out the difference of your trade price and the underlying index.

Payout Structure

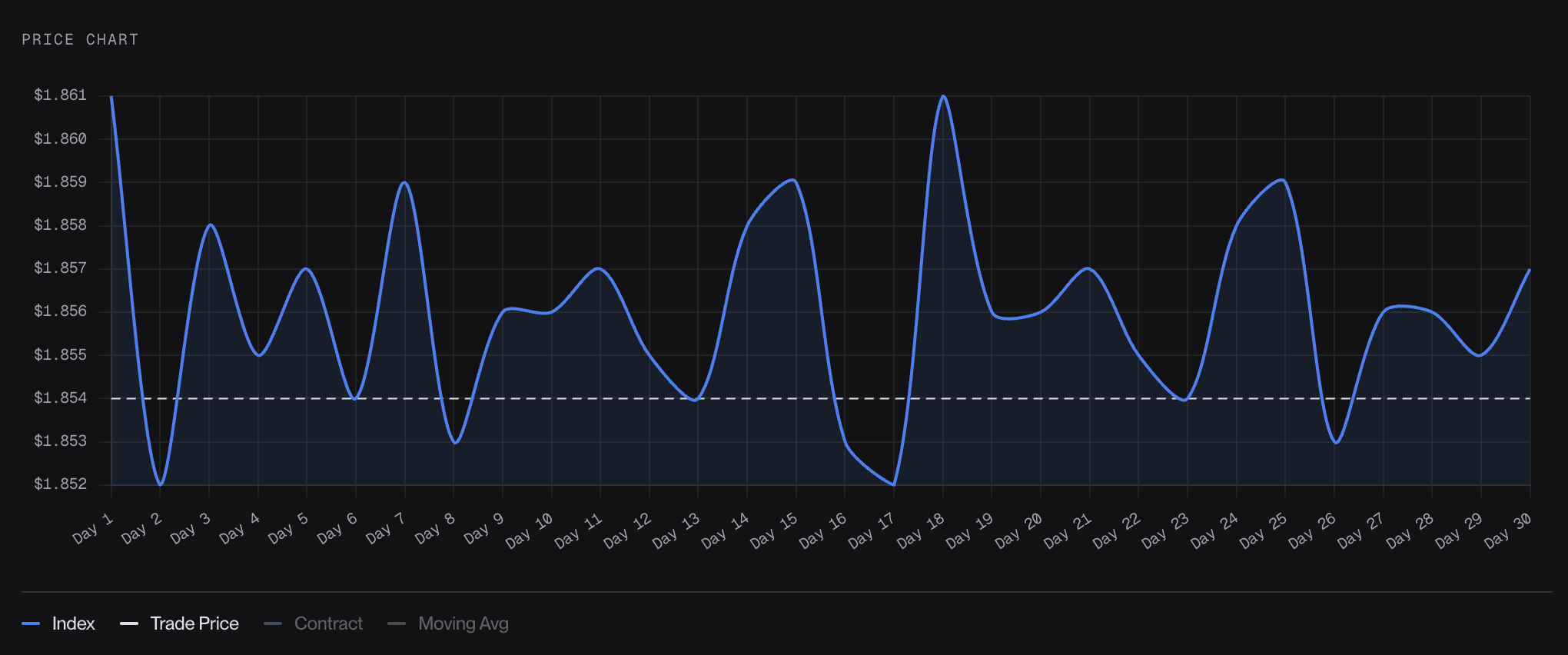

In our first post in this series, we argued for compute as an analog commodity to electricity. Taking inspiration from power markets, compute futures are “Asian-style,” where the payout is equal to the arithmetic average of index values observed through the tenor of the contract. Moreover, because index values are published daily, settlement can be realized incrementally throughout the life of the contract rather than only at expiry. For a monthly future, then, this would consist of 30 daily payouts based upon the difference of the trade price and the observed index values.

Sample Monthly Future outcome from Ornn. The payout for a long position is equal to a scaled difference of the index (blue curve) and the trade price (white dashed line). Here that’s 30 * 24 * (1.856 - 1.854) = 1.44.

The payout of an oil future—say, ICE Brent Crude—is given by the benchmark value at the end of its tenor. Terminal settlement works well for storable commodities like oil, where economic exposure is dominated by the spot price at expiry. Compute, however, is a flow commodity. What market participants care about is not the price of compute on a single day, but the average price paid over the period of use.

“Asian-style” settlement aligns the financial payoff of the contract with this economic reality. By settling on the arithmetic average of daily index values, a compute future effectively locks in a fixed price per GPU-hour across the tenor of the contract, mirroring how compute is actually consumed and billed in practice.

Margin and Counterparty Risk

This sounds all well and good. I can hedge my compute exposure via a simple cash future? Great! Where can I sign up?

A cautious operator will surely ask about counterparty risk. Who’s to guarantee that the loser of a trade will pay out the winner? Outside of the clear reputational loss, compute futures require margin, where counterparties must put up cash as collateral in order to guarantee their positions.

So at a high level, margin serves two purposes. First, it protects market participants from the risk of counterparty default by requiring that sufficient collateral be posted before losses are realized. Second, it ensures that daily gains and losses can be settled as they accrue, preventing losses from compounding unchecked over the life of a contract. Margin protects both sides transacting a compute future.

A Price Discovery Layer

Compute is quietly becoming one of the most critical inputs to the modern economy, and yet it remains one of the least financially transparent. Capital is deployed at colossal scales, exposure accumulates continuously, and participants are left managing GPU price risk with little more than hand-wavy balance sheet intuitions.

Compute futures change that. By anchoring settlement to a transparent benchmark, structuring payouts around flow structure, and managing counterparty risk through margin, these contracts make the value of compute explicitly tradable. Free markets converge on a value. They allow consumers, producers, and investors to hedge real economic exposure without taking on delivery risk or operational complexity.

The result is not financialization for its own sake, but a foundation—a market structure that supports price discovery, risk transfer, and long-term planning in an ecosystem where compute has become essential infrastructure. As AI continues to scale, the ability to trade compute risk will become as fundamental as the capability to trade power or fuel.

At Ornn, we’re ushering in that world.